Rugpulls and Robots

Some short term structural issues could lead to markets getting loose to the downside. Then we take another look into AV's, Robotics, and End of Year Rips

The rollover never happened. After some vol into the Fed meeting, smallcaps jammed to new highs and held:

The Fed guidance on cuts into end of year helps a ton, because it gives smaller companies better financing terms at banks, and some of the floating rate debt puts cash back into the companies instead of the lenders.

I’ve talked about the second order effects already, and planned out two Convex setups in small-cap-land.

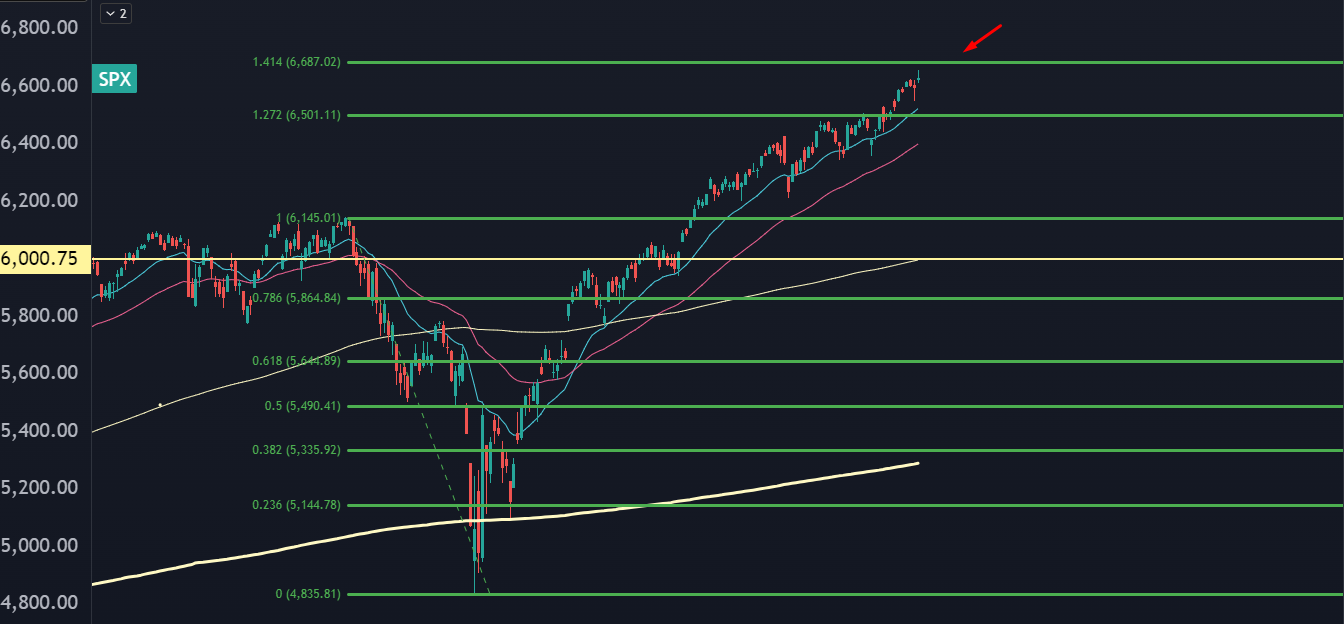

In large-caps there could be some headwinds, just on a technical basis.

For the mathematically inclined, the S&P 500 is coming up into an extension level that may end up being self-reinforcing enough to bring in sellers. There’s also a few pivot points floating around in that area, so don’t be shocked if some sellers show up.

We’re seeing the same for NDX:

There’s some other structural risks in the options market:

September VIX came off the board

Fed risk unwinding out of short term options

Equity options have monthly and quarterly expirations tomorrow

I’m not calling for a crash, but we could see a short term unwind in some trades. That unwind hit some names on Thursday afternoon, like OKLO:

And OKLO:

It’s been a good run in momentum land recently. Some of that liquidity demand was driven by call option flow, and it may be time to blow out some degens who held on to their Sep calls just for one more day.

The Worst Monopoly Of All Time Is Taken To Court

Live Nation (LYV) had a rugpull midday as the FTC announced they’re going after Ticketmaster.

This company sucks. Their trade practices would not happen in a free market, but because they are vertically integrated they effectively have a monopoly on events.

Live Nation owns Ticketmaster, but also owns top venues, artist management, and promotions. They also have strong-armed other venues into contracts that lock up the venue for a long time.

This has been well documented, so I won’t belabor the point.

The stock just hit new highs so if regulatory risk hits I wouldn’t be shocked of a retest of the 200 EMA (yellow line).

It’s kind of like United Healthcare (UNH). Sucks for investors, but I wouldn’t shed a tear for the company.

Another Automation Arena

Over the past month, stocks in the Automated Vehicle (AV) space have been rocketing higher. LYFT had the gap higher on the Nashville news. UBER is trying to crack $100, and TSLA is jamming higher on the FSD rollout.

I think adoption could be much faster in Asia due to density, demographics, and dictators. That’s why Convex Spaces Clients were alerted to a setup in PONY, a Chinese AV/AI play. Our Dec $20 Calls are up from $1.10 to $2.10, getting close to a double… and I think it’s just getting started.

We’ve got one more AV trade for CS Clients today, but before we look at that I want to look at the next phase.

What do you call a car with automated driving?

A robot. It’s just a robot with wheels. That means when we conceptualize the AV ecosystem, it should be nested under the entire robotics umbrella.

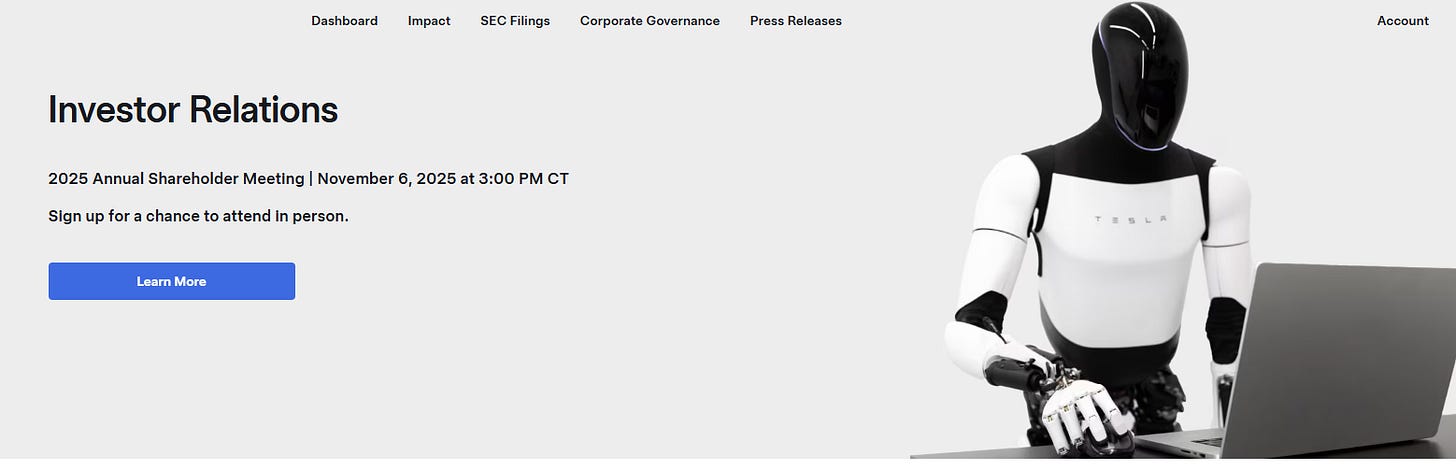

As a trader, I’m not looking just at price action, I’m considering Narrative and Catalysts as well. And that means going to the company’s IR site and figuring out what they’re trying to communicate to investors and whether they’re doing a good job of it.

Sometimes company leadership leaves signals in transcripts and press releases that the market hasn’t caught onto… not because the news isn’t significant but because their company just doesn’t get enough coverage.

Let me give you a screenshot of the IR page for TSLA:

DO YOU SEE A CAR?

What do you think they’re trying to tell us?

TSLA is not a car company. Their FSD car is just a robot with wheels. They’re actually a robotics/AI company.

And this trade is just starting to take off.

RR has a very real chance of going parabolic in the next few weeks:

(Yes, CS Clients were alerted to this on Aug 11th when the stock was trading at 2.11, so it’s a double here.)

You could also just check the performance of HUMN, an ETF for humanoid robots:

I know a lot of that price movement is just in TSLA, but there’s some international stocks that are looking hot, like UBTech, which is listed in Hong Kong:

And in the private markets, Figure AI just raised $1B on a $39B valuation.

It could get weird in the real world as the robotic adoption curve accelerates. The robotic innovations that are about to hit can be viewed as the “Physical AI” layer, and many of these names haven’t had any parabolic moves in the past few months.

And many of these names have cheap options.

Are you ready to get some solid plays in your portfolio? Become a Client at Convex Spaces and you’ll receive the best investing and trading setups out there. If you join as an Annual member, reach out and you’ll get all of my option trading courses included at no additional cost.