The Orange Juice Rally

There are incredible "off the radar" setups in the stock market. Here's where to look.

It’s always a $300 order when I go into Sam’s. Not just from the pallet of energy drinks (long MNST), but the bulk chicken and beef I buy to make it through the next two weeks.

And then there’s the “fun” things that add up. I didn’t know I needed a 5 pound tub of queso, but the sample was incredible and I’m already through half of it and it’s been 6 hours. Don’t judge.

What gets me every single time is the fresh squeezed orange juice.

It just hits different. That’s because the normal orange juice in the store is this Frankenstein abomination where they put the OJ in a tank for months, and then they add back in the flavor with terpenes derived from the skins.

(Congratulations, you’re now an orange juice truther.)

But the fresh squeezed stuff is now 10 bucks a bottle!

I try to avoid it, but it’s right next to the cold room that has the produce.

And she is there. Every time. Selling the juice. She’s a 65 year old Thai war bride. Lovely woman. An old-school hawker, pitching the OJ at a volume that breaks the background music.

If you make eye contact with her, you’re buying the juice. It’s worth it every time.

The markets are in “orange juice” mode. It’s the same stocks being hawked every single day.

The narrative concentration has narrowed to a few pockets, which we explained in our Coca Cola Market article.

Quantum. Rockets. Nuclear. Small Defense. Quantum. AI Infrastructure. Robotics.

We’ve been playing every single one of these industries with call options, and they all paid. Very well.

But it’s not fresh squeezed. It’s concentrate, removed of its essense and recycled back to short sellers and bag holders. For many names, the juice isn’t worth the squeeze.

Some other sectors are, and you may not be paying attention to them. Like pharma stocks.

Sneaky Bios

Look at this chart of XBI (biotech) from August 20th:

Just from a technical analysis perspective, it looks like a ton of overhead resistance, and biotech had been underperforming for years.

Here’s what it looks like now:

It just blew right past everything, driven by some solid catalysts in the space.

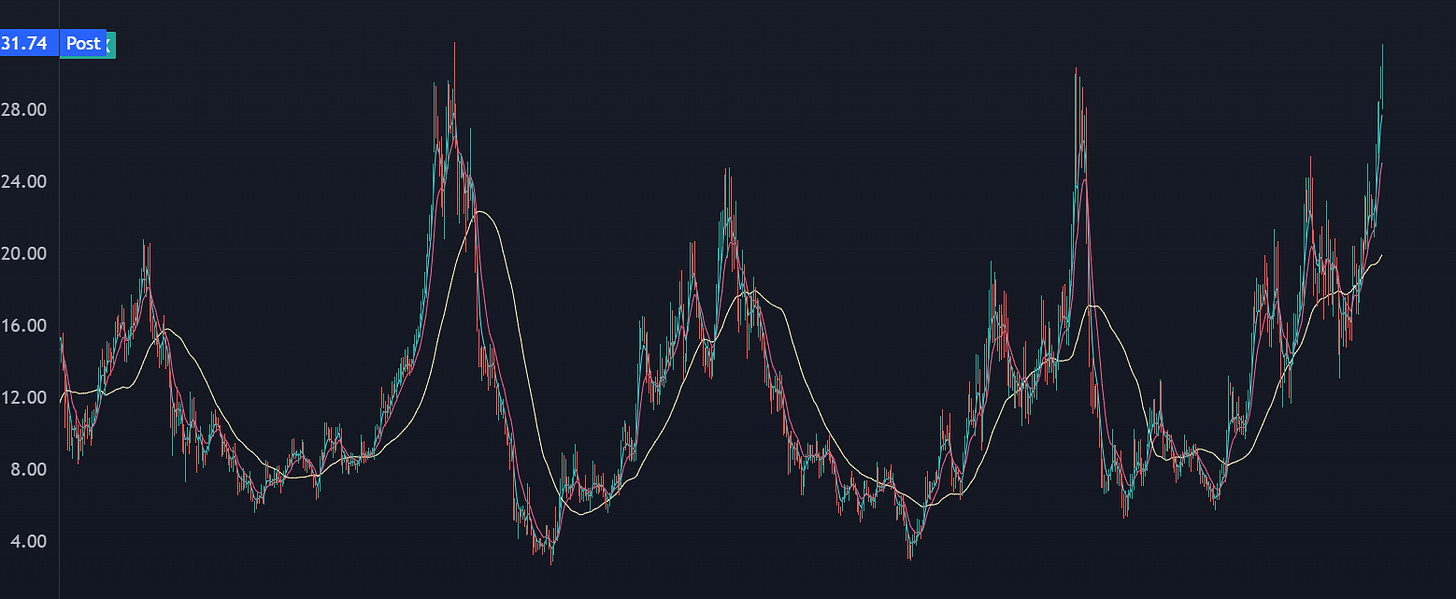

It’s just getting started. Here’s the a weekly chart of the performance of XBI against the Russell 2000 index:

When we see rates head down, things tend to get weird in biotech. AI will make it weirder.

The cost to acquire a patient can run 30-70k per person for FDA trials. That cost is already heading lower. You also have AI generated drug discoveries and rapid testing facilities that allow faster feedback and better drug selection for trials.

We’re talking about a sector-wide repricing that could hit over the next 9-12 months.

What’s another sector? Materials.

You Need Stuff To Build Data Centers

If you think electrical wiring? What’s the metal that comes to mind?

Copper. Which is what you use in houses. Yet in high-power, industrial settings, you use aluminum.

Which is why CENX is nearly a double over the past year:

And I know investors have been focused on solar as an AI proxy trade, but we’re absolutely going to burn more coal to generate electriciy.

Which is why BTU has gone absolutely parabolic:

These names normally are boring, but they have a fire under their ass as funds are scrambling to reallocate into these sectors.

Here’s the best part about materials stocks— the options market is not hyped, which makes the options cheap. You can capture a ton of convexity on rallies like this without a ton of cash on the table.

The next bull market has already started, but nobody’s paying attention because they’re arguing about quantum stocks.

GLD Is Stretched. Hilariously.

Back in 2011, I attended a fundraiser at the local kids museum. Most of my work was online so it was good to go talk to people in real life so I don’t go crazy.

Nobody was involved in the markets aside from the usual 401(k) allocations.

But there was this one guy.

You know how you get super beared up when your taxi driver starts talking about all the call options he has in some hype stock?

It was like that, but worse.

He was a silver investor. He owned one of those “we buy gold” pawn shops. And he had a talk radio show that was exactly what you would expect.

You may not remember the silver squeeze in 2011, but it was the wildest move since the Hunt brothers cornered the market in the 1970s. It was an incredible run.

Earlier that day I told my clients to get short silver by shorting call options.

You can imagine how this conversation went. “This time is different, the Fed has printed, don’t ever sell, look at how cool I am that I’ve been bullish on silver for 20 years and dramatically underperformed the market until the past 10 trading days!”

Yeah, it was a signal.

Silver got cut in half in the next few months. The next time I saw him, I went to his shop and asked how much his silver eagles cost, because I wanted to buy them.

I think he tried to sell them to me at a massive premium out of spite. I ended up buying them online.

I’m not bearish on silver… yet. It’s not that stretched.

But gold is.

Ignore the macro talk for a moment. Think about liquidity, positioning, and speed.

The rolling 1 year return for gold is over 25%. This has happened only a few times in modern markets: 2006, 2008, 2011, and 2020.

Now let’s look at how gold is trading against USD:

That’s a solid non-confirmation. I understand that flows are also coming from international markets, and the last upside juice was a response to the Japanese elections.

Yet it’s reasonable to look for a pullback. It doesn’t have to be a crash, but just a normal pullback.

That’s the trade we’re going to look at first.