The Rugpull

Why the market feels worse today than what the numbers suggest. And a quick gameplan for how to trade these markets into the end of the month.

A quick note today!

A few days ago, I laid out a list of hypothetical narrative shifts that could overtake Wall Street’s obsession over the Fed.

We got a hit on our bingo card:

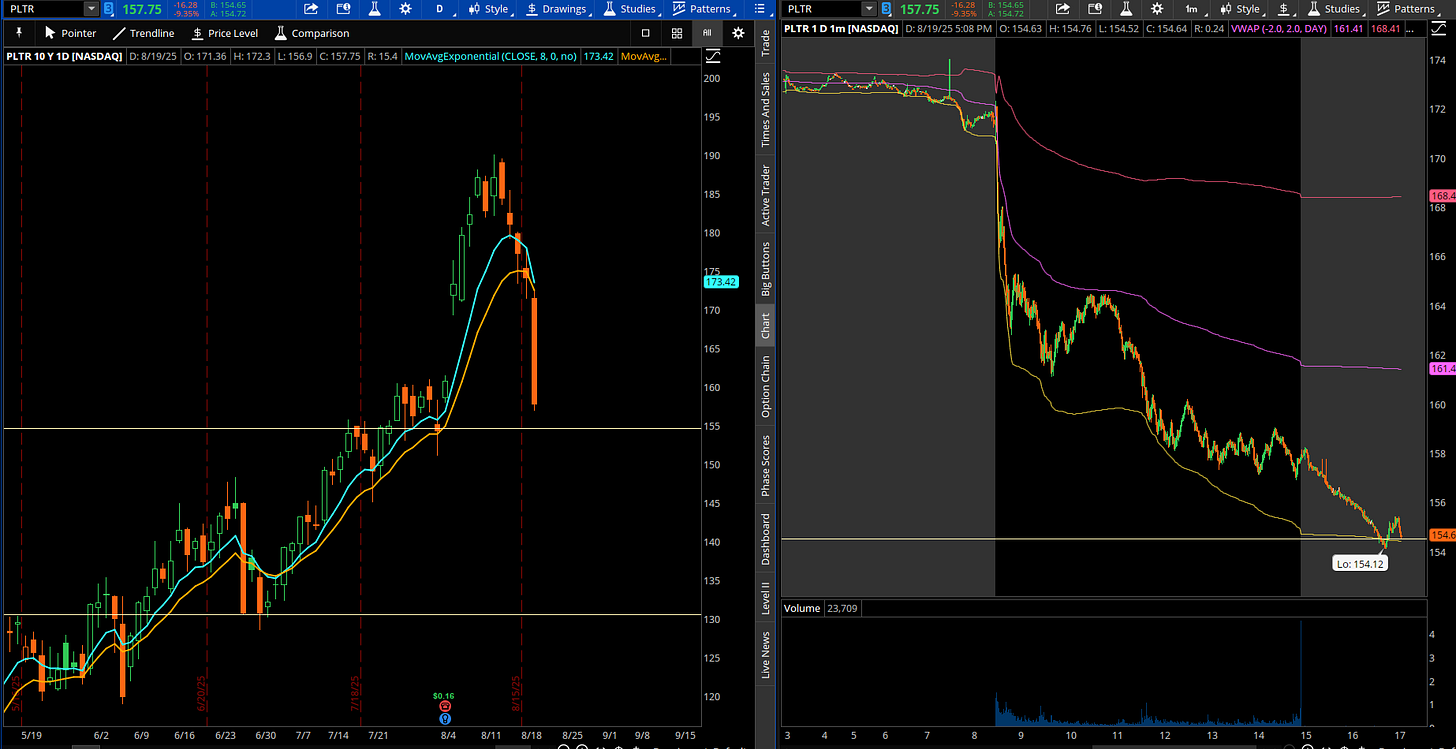

Palantir (PLTR) got taken to the woodshed today, a -3.4 standard deviation move. Sellers accelerated into the aftermarket session.

The stock is trading like some size got stuck, regardless of the newsflow that hit today. This is the “big kahuna” momentum trade in this cycle, so when the leader gets hit, the entire “high risk” stock complex got taken out.

Momentum trading is hard at the end of the cycle. You always look like a giant idiot into a turn like this, and (hopefully) you take comfort in some of the massive wins you got from earlier in the trend.

Was That It?

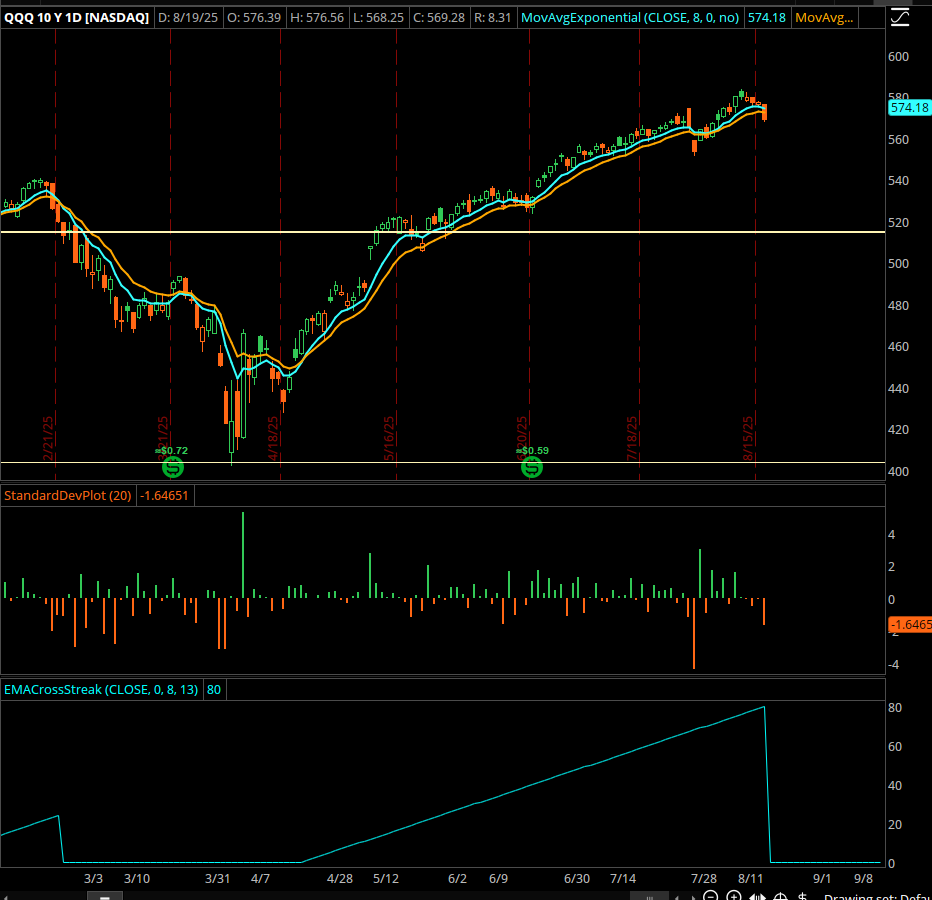

This cycle has been stretched, not in terms of price movement but time. One way to measure this is to look at how many consecutive days that the market has seen it’s 8EMA above its 13EMA.

(The 8/13 cross is a straightforward short term trend indicator.)

The Nasdaq 100 is now on day 80 in this bullish condition. That’s 4 months, something that doesn’t happen often. The last time we had this duration was the Aug 2020 market top. Before that it was the COVID top, and before that was a correction in April 2019.

These are small sample sizes and each was a unique situation, so don’t get all beared up just yet. Even with today’s selloff, the 8/13 cross is still in bullish alignment.

I don’t think we can get a hard pull lower, at least not yet. Options have continued to overprice volatility, and that kind of structure helps keep a bid on the market.

But I do wonder… what happens if the option flows that have been helping keep liquidity on the bid… just stops? Can these megacap tech stocks manage to maintain their valuations if the 0DTE gang takes a break?

Pathing Forward

Base case is a rotational time based correction. We’ve already started to see signs of that with capital flows into smallcaps, as shown by the relative performance of IWM to QQQ:

That means you’re going to do well trading range and reversion on names like NVDA and MSFT.

There’s also a clear case to be made for industrials

And if risk still has a structural bid into the Fall, a new batch of momentum darlings will show up, names that didn’t run 100%+ through the summer will get us some cheap options to lever up on the next cycle higher.

It’s still HILARIOUSLY early to try and call for a major market top. Today was a rug pull in momentum, and the S&P 500 only finished down -0.50%.