The Tepper Tantrum

The Post-Fed Market, David's Big Bet, and the Preference Cascade in AV's

Back in December 2024, David Tepper told us to “buy everything.”

In China.

He was responding to the starting of the Fed cut cycle and how it coincided with recent Chinese stimulus.

Now when you’re a billionaire fund manager, you’re talking your book and you can afford to be early.

And he was pilloried for the call when the Tariff Tantrum hit.

But the Tepper Tantrum is back, and it’s just getting started.

Here’s a video where I show the link between US rates and China:

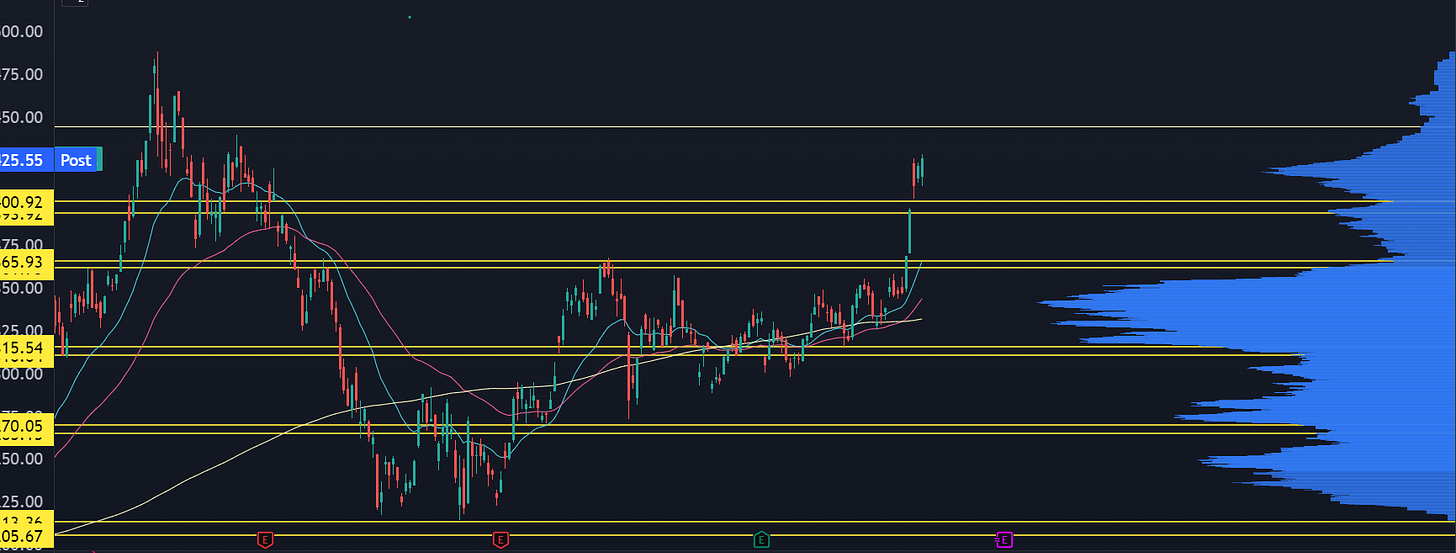

There’s a Convex setup in China with AI. China tech shares are just lifting out of a multi-year range, while US AI companies like MSFT and GOOGL (and now ORCL!) are in full blown parabolic mode.

They may be able to deploy AI faster at the civic level, because they do have a kind of techno-autocracy that enables policy rollout faster.

We’ve had some solid setups that are at a good spot to take some gains or roll up the calls.

Convex Spaces Clients had BABA Oct $140 Calls lined up at $3.50, and those are now trading at about $27.90 for a 697% win.

We also pounced on BIDU Jan $120 calls at 1.80. Those had a 16 delta, which for most people seems very out of the money, but my bet was that the options market was underpricing the upside move.

And it was.

Those calls are now at $26.50, a 1375% win.

While these trades have been monsters, the China trade isn’t over. There’s some names where they’ve stayed subdued due to tariff risk or just a lack of exposure. It’s still in play.

Do Not Miss The Autonomous Vehicle Trade

This breakout in TSLA is sticking. It was the first push out of a range, it’s not a crowded trade, and they’ve got a ton of tailwinds that can push more people into the name.

Those tailwinds end up working for other names, too.

A rising tide can lift all boats, but a strong wind helps those companies that had their sails pointed in the right direction.

(What a line. Like out of a Wall Street fortune cookie. This would be a pull quote they put on a Peter Lynch book.)

LYFT caught a bid today announcing that Waymo is going into Nashville.

Autonomous Vehicle tech is a margin expander for operators, and they’re going to become ubiquitous (and accepted) faster than what people think.

Did Convex Spaces clients get a LYFT trade? Yes. Are they killing it? Up +944%. Do we also have UBER calls that just suck right now? You bet.

We also did do a deep dive into another name in the AV space yesterday, with a new trade ready to go for Convex Spaces clients. If you aren’t one yet, you should be. We’ve got a deal going on right now where if you pick up the annual subscription, then you’ll receive all of my option trading courses as a gift for being a founding Client. Just sign up, then let me know in the chat and you’ll receive unlimited access. You can go here to subscribe.

Grumpy Old Man Options Trader Explains Why The Market Is Holding A Bid

At some point, the market will rollover. Not crash, but something like a 5% pullback that chops around for three weeks and makes everyone miserable.

I don’t think we’re there yet… because there’s a structurally embedded bid in the markets.

Yeterday, I put out a video talking about how the market will top out after the headline risk goes away.

You can watch it here:

Today I put together a followup, and this one gets a little more advanced. I take you through the life of a market maker and the kinds of trade flows that they are making a killing on.

You’ll see how persistent long term hedging demand is keeping intraday volatility dampened, and how it’s leading to an incredibly stable market.

You can watch it here:

Meanwhile, NVDA Still Sucks

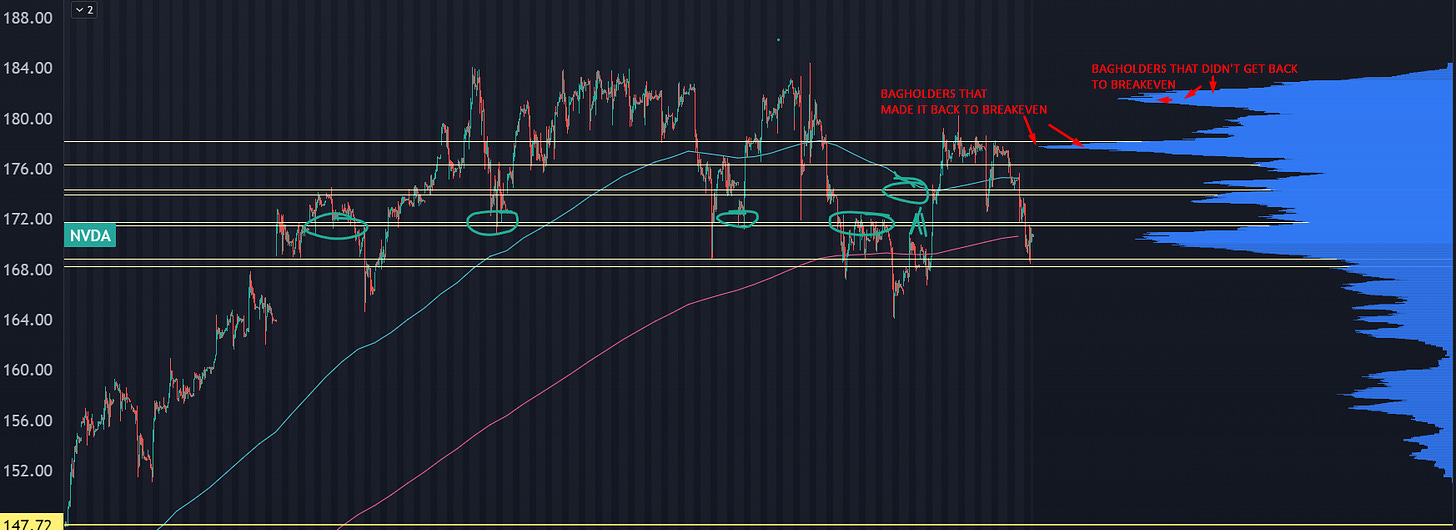

These levels have been on my chart since August, and I’ve been wargaming a topping process in NVDA. It’s starting to play out.

The onus is now on new buyers. The longer time goes on without a reclaim of 174, the more impatient the bagholders are going to be. Here’s what it looks like with some more data and volume:

This doesn’t feel like a collapse, more like rotation onto better plays.

Like China.

Next Up For CS Clients

The upside tails aren’t as cheap as what they were a few weeks ago, so now’s a good time to use call spreads in your favor.

We’ll be looking at that in a lagging China name, as well as a few momentum continuation setups in AI and cannabis stocks.