There Are Rugs, And There Are Rugs.

This weekend has been a case study in a Liquidity Framework of trading, investing, and risk. You'll see how the market selloff and crypto crash have hidden bullish benefits.

Hangovers

Three years ago, I attended the W3BX Event at the Wynn. It was billed as a conference that combined traditional investing, venture capital, and crypto.

I’m from the first group, but I did my best to fit in with the crypto bros:

The event was incredible. For those who attended, it allowed collabs and crossovers that wouldn’t have been possible, because there’s not many events that were multi-disciplined like this.

But it was a virtual ghost town. This was in October 2022 and we were in the full throes of a bear market in crypto assets.

BTC traded down from 70k to 20k. In a few weeks, FTX would collapse. It wasn’t just crypto. NVDA was down 60% from its highs, trading at a split-adjusted price of $13.

I spoke on a panel in a conference room that sat well over a thousand people. About 50 were there when we spoke, half were friends of the panel. I spoke with some of the organizers and they shared that a lot of people were watching the webcasts, but cancelled the trip at the last moment. Our guess was the bear market had been rough all around.

The 2022 bear market was driven by long term liquidity outflows due to tightening financial conditions, a reduced wealth effect, and a sustained cascade of blowups.

Over this weekend, the crypto market crashed. This follows a hard pullback in stocks due to tariff headlines that finally hit.

The question at the front of everyone’s minds is… was that it? Did risk assets top out and we have to look forward to another soul-sucking bear market?

It sure felt like it at the time.

A single catalyst led to incredible unwinds. Entire positions were blown out, very publicly, due to on-chain transactions. Hyperliquid saw over $1B change hands, with 1,000 account blowups.

Exchanges with lower liquidity saw complete dislocations. ATOM briefly traded at $0 due to forced account liquidations and zero buyers on the bid. Binance’s plumbing broke with order matching failing.

But I don’t think that the flush from the past three days is categorically a bad thing. If you use my “liquidity-volatility” lens, then it starts to paint a different picture.

Because we’ve seen this before.

Flash Crash

Back in 2010, I was live on StockwitsTV when it started. I wasn’t in a panic. It was more confusion, I kept thinking they were bad prints. Once I started to see the news flow (and order flow), I believe I said something along the lines of “g2g, need to sell put spreads.”

If you’ve not heard Bill Lichtenstein talk through the crash, do yourself and favor and give it a listen:

There was a fat finger seller in the futures market, which spilled over into stocks. The problem was, HFT’s were constantly printing false liquidity, and everyone assumed that the market was a lot thicker than what it was during times of stress.

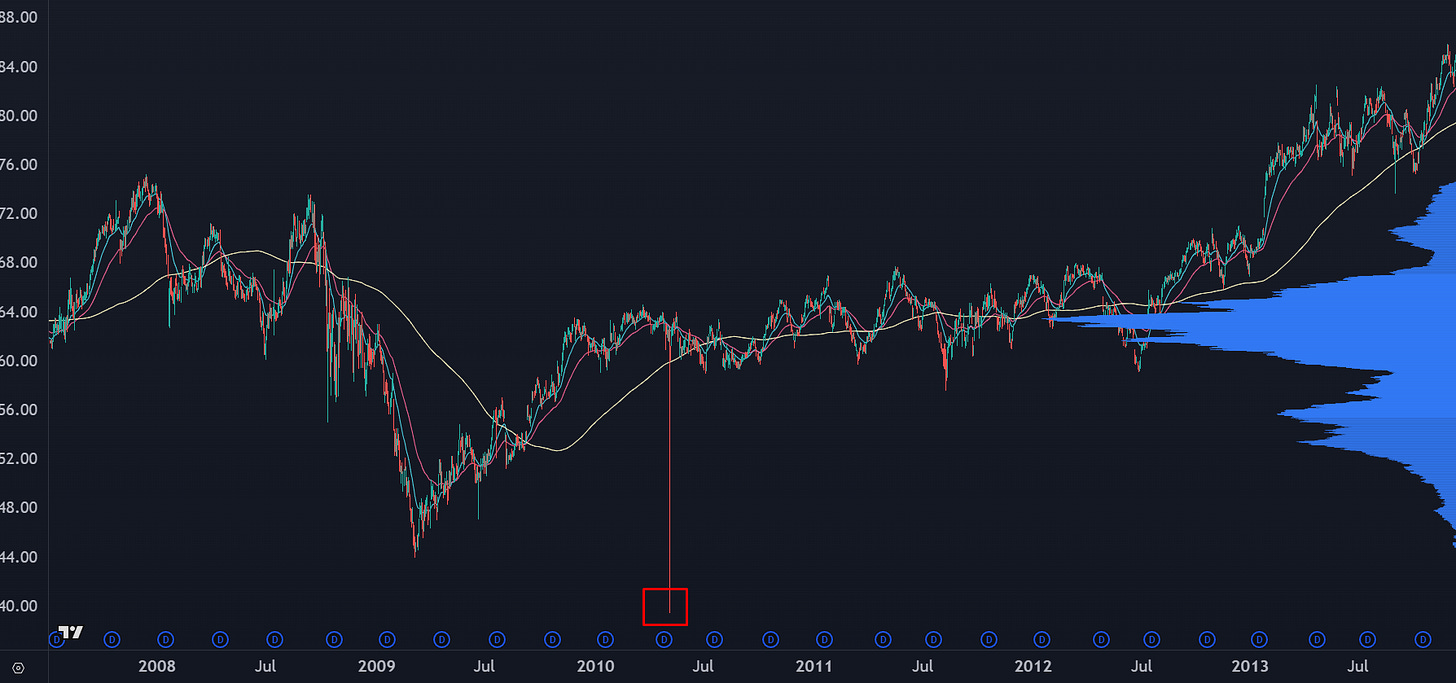

This led to some insane moves on single stocks, like Proctor And Gamble (PG) trading from 60 to 40:

This was a Liquidity Event, where structural issues cause a cascade, and a stable market turned out to be a clown show.

These liquidity events can hit during longer term capitulation, like when money market funds broke in 2008, or when short volatility got blown out in 2020.

They can also be caused by indiscriminate buying, like the short squeeze in KODK and GME a few years after.

Lately the Liquidity Events have become more complex, with derivatives involved, like Volmageddon in February 2018 and the subsequent Tech Wreck options blowout in December.

They can also come out of nowhere.

The Swiss National Bank decided to kill the speculators by announcing a currency depeg at a low liquidity time of day.

We can add the Oct 2025 flash crash in crypto to the list. They all carry similarities: something went wrong with the plumbing in the market, too many participants assumed liquidity that wasn’t there, and there was hidden leverage in the system that gets wiped out.

These Liquidity Events end up being a net good for whatever market they’re trading. That’s no solace for those that were blown up. It never is. Yet each time, it creates more robustness in the system. We get more information, better risk management, and improved plumbing.

Heck we now know oil can trade at a negative price!

There are still flaws in modern markets, and there will be more events like this. But they do not guarantee a bear market.

A Better Way To Think About Markets

It took me over a decade to truly understand this. It’s hard to fully describe, but with the recent events from both equities and crypto, it provides an incredible path to see how to better approach the markets.

Here is the framework that I use to think about markets and options.

1. Liquidity and Volatility Are The Same Thing

Think about it: if the market has a ton of liquidity on the bid and offer, price doesn’t move around that much.

But if we’re limit down on a Sunday night, then it’s going to be a wild ride on Monday as there will be fewer participants willing to play the market without getting filled very far away from the current price.

When markets are fast and loose, liquidity is low and volatility is high.

When markets are slow and tight, liquidity is high and volatility is low.

2. Vol Is Just Math

Another way to think about it is that vol is the statistical representation of how easy it is to get filled in a market. If it were easy and anyone could do it, then price would never move.

When you see the VIX, which is currently at 21%, it’s the expectation of what returns could be a year from now. You can break that down further with a monthly expectation of 6% and a daily move of 1.3%.

But remember that prices only move when there’s no marginal liquidity. The percentage shown on the VIX (and VIX futures) are more of an abstraction, estimating the range that the market can trade in, which is a function of liquidity.

3. It’s How You Get An Edge

This is why markets aren’t efficient. They can’t be. You need infinite liquidity, and that doesn’t exist.

Options (and vol markets) are priced based off of future expectations of volatility. Which means options are trying to figure out the future liquidity of a market. Options markets are very good at pricing risk for tomorrow, but terrible the longer they go out.

As a trader and investor, you make money when there’s an inefficiency in the market. Which means you’re making a bet on liquidity. And vol.

That goes doubly so for options traders, where you are searching for mispricings… not just in the underlying but also the option’s future pricing of {risk | liquidity | volatility}.

4. Leverage Brings In More Liquidity

In late 2017, the hot trade was to short vol by way of an exchange traded note called XIV. It brought in so much new cash into the VIX markets that it had a cascading effect that dampened the actual volatility in the market.

The S&P 500 traded with a single digit vol for 4 months. At some point, the size in the vol market was overpositioned and caused a systemic break called Volmageddon.

Compare that with the rugpull in crypto.

Major exchanges were cranking up the leverage in the perps market. This was part of an arms race against decentralized exchanges that were already offering high leveraged exposure.

I’m not making this up— Binance gives you 75x leverage on FARTCOIN.

If you’re a speculator that sounds great, because these markets can move fast.

Yet leverage introduces liquidity, which has kept a lot of less-liquid Altcoins from moving. Not all leveraged traders were straight up long and short, they were running arbs between tokens as well as exchanges.

Those arbs end up suppressing volatility, which can end up suppressing trends.

Understanding that volatility and liquidity are the same thing help open your mind as how the market operates. You’re not betting on company fundamentals or a line on a chart, you’re thinking about positioning and motivations of other market participants based on the information you’re seeing.

Every elite trader and investor that I know think through this lens, although many don’t realize it. It’s like explaining water to a shark.

With this framework, let’s dig into some outcomes in both the stock and crypto market.

My Crystal Ball Predictions Into Year End.

I had already expected some of the major themes to fizzle out as they had reached peak narrative and were very stretched.

Yet what actually happened was that Tariff headline bubbled up from the surface.

This may seem like a big deal to the markets, but the problem is that it’s been priced in for 4 months. The VIX has been overpricing the actual volatility in the market since the first Tariff Tantrum.

In other words, there’s been a lot more liquidity in the market than what hedgers are currently paying. And while it did pay off this Friday, that’s 4 months of very expensive hedging costs.

The source of that liquidity in the stock market has to do with 0DTEs. Just like perps in crypto, this fast-moving market trades an incredible notional value per day.

I stepped through how this creates a kind of liquidity flywheel in the markets. I also explain how a pullback could happen when it reverses.

Friday’s move was a hard selloff on the headline, but the cascade hit due to hard unwinds in the 0DTE market. My other guess would be there were some busted trades when everything got hypercorrelated into the selloff.

Over the next few days I’m going to be watching price action in the indices and Mag7 stocks to see if there’s any signs of forced selling or an uptick in volume. I’m also interested in seeing if a few of the highly-shorted future tech names have one more short squeeze.

The reason names like IONQ and RGTI didn’t get killed on Friday is because the people who were short those names were also stuck long in many other positions, and they provided more demand. If a fund blows up and they’re forced to close, it could get weird in Midcap Futuretech land.

Circle back to the headlines. The big ones are:

Mag7 Earnings

Tariff Negotiation Deadline.

These are all at the end October to the beginning of November. Options risk pricing is going to stay bid, and that changes how vol trades. That may make it tougher for liquidity to persist in the 0DTE market.

That could mean wider ranges and a few nasty stop loss runs, both long and short. Too many have been conditions for small daily ranges, but if liquidity comes out of the market due to deleveraging, then you can’t account for that.

Some dumb, choppy, news driven mess of a range that punishes both sides and burns through a lot of options.

If there aren’t any headlines out of left field, and Tariff negotiations resolve in a not-that-shitty way, and Mag7 has good price reaction to earnings… then we’re setup for a rally into December and a hard push to start the year.

We’re not thinking about fundamentals, but how structural liquidity flows in the options market have been keeping ranges low, and that’s been disrupted. But once we get through the headlines, we normalize our vol structure, liquidity releverages, and then the market marches higher.

What About The Crypto Markets?

Back in 2022, Crypto had its version of Bear Stearns and Lehman Brothers. Exchanges went under, people went to jail, and investors were wiped out.

And just like the Great Financial Crisis, new financial technology came online to bring in serious liquidity into the market. For TradFi, it was HFTs, and DeFi it was a lot of things all at once.

The Crypto/DeFi market had its first Flash Crash as a fully legitimate market.

The liquidity wasn’t real when it was stress tested. And it wiped out a ton of leverage.

Pulling out that leverage reduces liquidity, which increases volatility, which allows for breakouts to actually stick.

Prior to 2020, there weren’t a lot of easy ways to get involved in crypto. Now, you’ve got dozens of crypto treasury companies that give you direct access. Spot ETFs are now incredibly liquid. And passive investors are starting to allocate.

Crypto is quickly evolving to emulate current TradFi markets.

Megacap tech is incredibly concentrated in index funds. We’ll see something like that in crypto markets, where BTC, ETH, and a few others become the primary assets that have bridged over to Wall Street.

This is creating a “perfect storm” in crypto.

The normal cycle in crypto is that the top tokens go on a ripper, and then excess liquidity demand from those spill over into smaller, lesser known tokens.

That cycle never seemed to hit after the most recent run in BTC and ETH.

Yet if we consider that volatility has been suppressed by leveraged liquidity via perps, then breakouts and momentum may start to show up at a higher rate in other markets.

Over the next week or so we’re going to see if there’s any bodies buried, and if there’s any bagholders that are forced to exit. If there aren’t any systemic risks, then I expect a similar range to build out in crypto assets like the equities market.

Crypto does have some reliance on flows from treasuries and ETFs, which is dependent on the risk appetite of US equity investors. That means crypto will end up being a leveraged bet on Mag7 earnings/Capex and Tariff news. If we get through those in one piece, then it could be alt season.

Post

These notes were part of my market prep over the weekend, that I ended up expanding so I could fully flesh out how I’m going to react to and play the market for the last quarter.

My predictions can easily be kneecapped by some unexpected headline. Any kind of post-range recovery may end up being much longer than I expect, or it can also just rip to new highs and leave everyone in the dust.

Yet I think this is the most probable outcome, given how risk has been priced into stocks, and how derivative flows in both stocks and crypto have been dictating how the underlying markets trade.

If you’d like to learn more about how I approach liquidity, I have an introduction to my PRICELINE framework here.