There's a Launch Pad On Top Of My Oil Derrick

Crypto city-states, spy satellites, and Texas spaceports

What do we say about boring markets?

The Nasdaq kept grinding up into the NVDA highs. Ranges keep compressing and realized volatility starts to come down, which helps put a bid in this market as you can’t justify vol futures at 20 when the market’s starting to trade like a 10 vol.

Until proven otherwise, we’ve got to assume that the broad indices will have a grinding, rotational, slow trend higher.

I’m focusing on in play stocks like CRWV, some short volatility ideas, and maybe… just maybe… I’ll try to short GE:

Today I’ve got 2 stock picks, a RegA deal, and plenty of stories.

The Hack to Get Cheap Reusable Rockets

In December 2023 I touched down at Kennedy Space Center.

It wasn’t Space Camp— I was there to take a look at the Starfighters operation.

We passed by the SpaceX and Blue Origin sites, and then were blown away by the Vehicle Assembly Building, the largest single story structure on the planet.

See that flag? That’s the area of a football field.

Starfighters has an incredible story. While SpaceX is trying to manufacture reusable rockets, Starfighters had already solved the problem.

You just take the rocket, then add wheels and a pilot.

Boom. Reusable.

The company takes modified AMRAAM missiles and sticks some satellites in them. They then take their fighter jets, get to Mach 2, and shoot the satellites into the sky.

Then the pilot lands the “rocket.”

Of course, payload limits their customer base, but Space Is Big. Their TAM is increasing each month.

At the time of this writing, they still have an Active RegA offering. I like the play, but you should do your own research and understand the risk profile of a RegA investment.

I’m bringing this company up because of a recent pivot they made.

They have built out a massive presence in Midland, Texas.

They aren’t the only ones. At least 11 aerospace companies have moved to the Midland International Air & Space Port.

I hope you stumbled over that sentence, because I did when I read it.

Why does the heart of the Permian Basin… Oil Country… have a Space Port?

The New Corridor Boomtown

A month ago, the DoD announced that they are on the hunt for “hypersonic corridors” so they can quickly test missiles. I’ve been wary of our lead in hypersonics because of some Chinese tests a few years back, so it’s a solid strategic bet.

Legislators are jockeying for their constituents to get in on the action.Because if you’re at an endpoint, then the locals are going to rake it in.

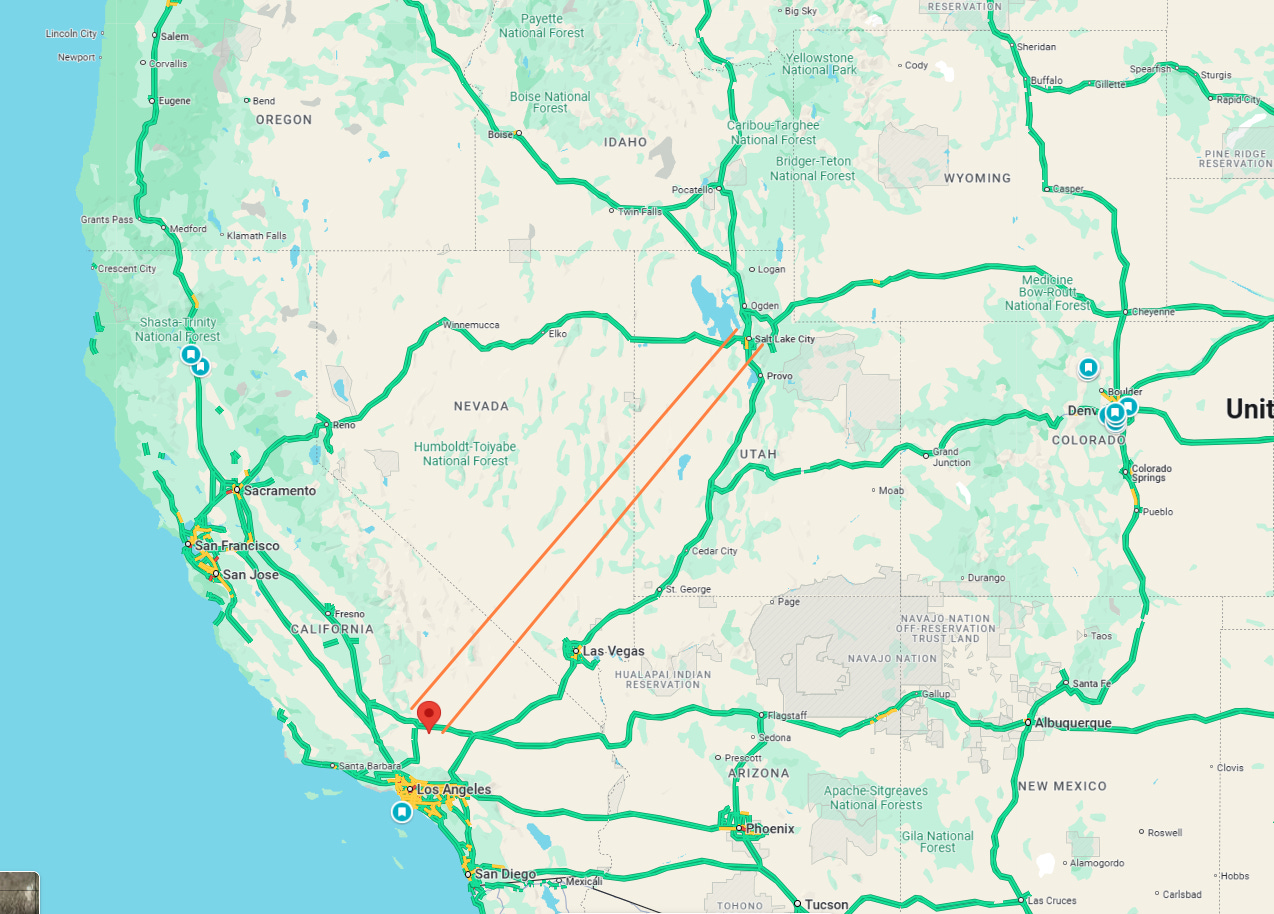

In 2023, Senator Mike Lee proposed a hypersonic corridor from Edwards AFB up into Utah.

There’s not been movement on that route yet.

But there’s enough positioning that the Vandenberg - Midlands corridor is going to open up.

I can’t believe I’m saying this, but Midlands could be the new Austin. Hot, flat and crowded.

Two Plays At The Ends of The Corridor

One other player in Midlands is AST Space Mobile. They’re building out broadband cellular.

In space.

The stock caught some hard momentum in May 2024. Well over a 10 bagger.

Since then it’s been dead money. You had profit takeovers, then momentum chasers, and way too many people trying to play the breakout.

But it’s heating up, and it feels like the timing is good.

There’s been sticky sellers from $28-30, if they clear out, then don’t be shocked if you see this one at $50 before summer’s over.

I’ve got another satellite play, this time from the other side of the corridor.

Planet Labs is an imaging company that primarily launches out of Vandenburg AFB. I’ve been bullish on this for a while, and they just had a solid earnings report.

(In case you didn’t know, I go live on twitter and youtube on Monday, Wednesday, and Friday at 12PM. You should stop by sometime.)

The stock caught a nice earnings spike on good news. They beat revenue estimates and are now at positive free cash flow.

This is still a busted up SPAC deal, but I’m optimistic about the momentum if it can take hold. Stock’s under $5, with a fast push you’ll see $7… if it can break that then it’s game on.

Praxis Makes a Play

Everything I’ve written today was triggered by a single news piece, and the dots all connected.

I’m a member of Praxis Society, which is a compelling (and fun) project about what it means to be sovereign. They had been banging their head up against a wall trying to get a Special Economic Zone (SEZ) built out on the Mediterranean, but couldn’t get the right deals in place.

They’ve looked at sites all over, including Nuuk, Greenland.

Today they announced a very ambitious project to build a spaceport city at Vandenberg AFB.

They want to have incredibly limited regulations so they can quickly build out infrastructure, AI, semiconductors, space, and every other technological accelerating agent.

I’m over the moon that Praxis is making a play in America. If they can prove the model out, then there will be massive capital flights in the real world.

It’s about to get weirder. Again.

There’s accelerating stakes in drone attacks, robotics are about to have a massive step up, and nuclear is going to melt up instead of meltdown.

The markets can’t easily price this in. It’s moving too fast and the markets don’t have enough liquidity for large participants to react to these trends.

Welcome to the Soaring Twenties.