✅ Transcript Summary (Convex Spaces Morning Market Update)

Market Context

Market has been heavy, but the broader structure still looks like a range reset, not a major trend break.

NASDAQ is retesting the October “rug pull” zone and sitting on a Swing-Anchored VWAP + 100EMA confluence, which could produce one more shove lower.

% of S&P 500 stocks above their 50-day MA is around 36%, a healthy reset inside a rising long-term trend.

Surface-level: some megacaps are holding (AAPL, AMZN, TSLA), some are breaking but approaching support (MSFT ~480), some are deeply oversold (META).

Equal-Weight View

Equal-weight S&P and equal-weight NASDAQ continue to nose under support.

Under-the-hood damage is already substantial; breadth reset is advanced.

Interpretation

Not calling a bottom—calling the start of a bottoming process.

“One more rug pull” is still on deck, but the market is stretched enough that upside mean reversion has edge.

Meta-Specific Notes

Meta tends to bottom through a process—multi-week resets like taper tantrum, last summer, etc.

After this overshoot down, a natural bounce could push price into the 620–632 zone, where:

declining 20EMA catches up

Swing-Anchored VWAP sits

prior structure lives

Setup Philosophy

You want to be early, not perfect.

Expect chop → bounce → chop.

Use a structure that:

benefits from time decay

allows adding on further weakness

doesn’t require immediate directional precision

✅ META Trade Setup (Weekly Call Calendar at 625)

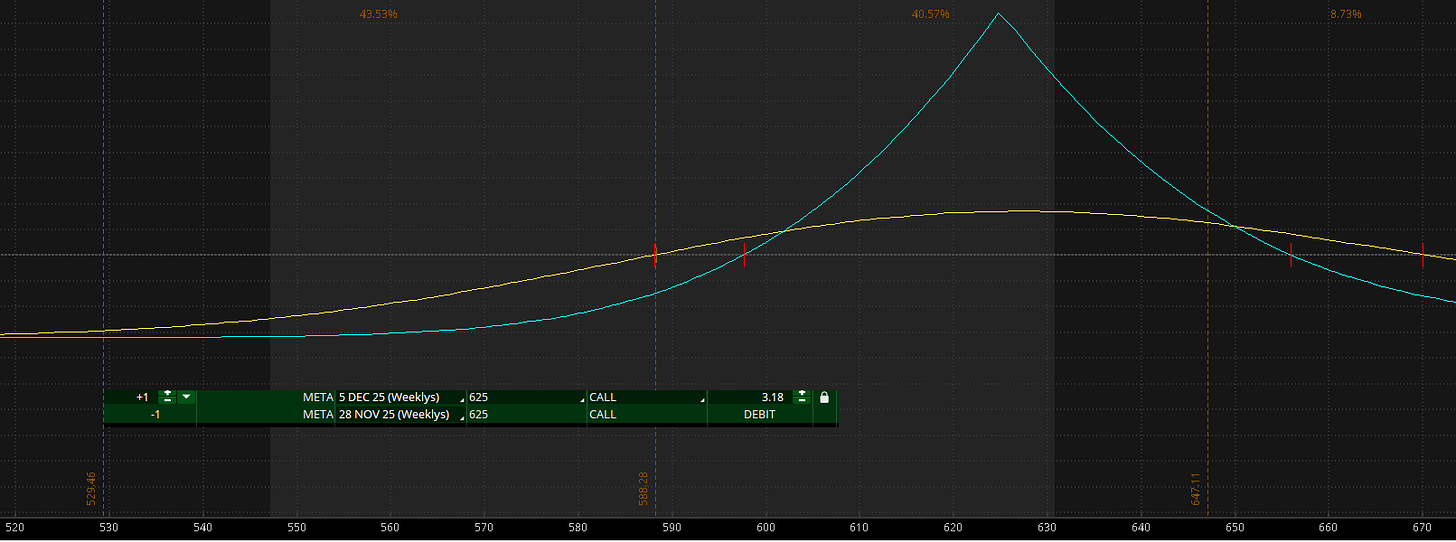

1. Structure

A call calendar using next-week short calls and the following week’s long calls.

Sell:

META 625 call – exp: Nov 28, 2025

Buy:

META 625 call – exp: Dec 5, 2025

Cost: ~$3.18 (reasonable fill)

2. Why this works now

Nobody wants calls right now, so upside vol is underpriced.

You capture:

Short-term IV decay on the short call

Directional upside via the long call

The trade is bullish, but not a leveraged chase.

Profit zone centered around 625–632, where key technical levels converge.

3. Expected Pathing

Meta rebounds into 625–632 → calendar pays nicely.

If it chops sideways → time decay works for you.

If it sells off → you can add lower-strike calendars (ex: at 615) to build a double-calendar for a bigger base.

4. If It Rips Immediately

A one-day squeeze above 650 would hurt (you go net short temporarily), but:

declining 20EMA

VWAP overhead

make a straight-up melt unlikely.

5. If Meta Dumps Another -10 to -12 Points

Add the same structure at lower strikes (e.g., 615).

Creates a double-calendar:

Increasing theta

Wider profit envelope

Stronger bounce-play gamma into December

6. Hidden Benefit: Forced Long

If META doesn’t reclaim 625 next week, you are left with:

Long December 625 calls for ~3.18 cost

B/E ~628

Totally reasonable upside target into December.

This becomes a cheap swing long if the calendar portion collapses.

✅ Bottom Line

Out-of-the-money weekly call calendars on META (and ORCL, AMZN) offer asymmetric reversion-to-mean upside with controlled risk.

Plays the bottom-formation process

Benefits from chop

Lets you scale into further weakness

Doesn’t require bottom-ticking

Primary Target Zone: 625–632

Primary Mechanism: Time decay + modest bounce

Edge: Underpriced upside volatility + technical reversion point overhead